The Cost of Full Repeal of the Affordable Care Act

Jan 4, 2017 - Committee for a Responsible Federal Budget

View a Printer-Friendly PDF Version

The Affordable Care Act (ACA), also known as gObamacare,h includes a number of provisions to expand health care coverage, as well as several offsets that raise taxes and slow the growth of Medicare spending.

According to our latest estimates, repealing the ACA in its entirety would cost roughly $350 billion through 2027 under conventional scoring and $150 billion using dynamic scoring.

In this paper, we offer rough estimates for a variety of full and partial repeal options. In addition to our full repeal score, we find that:

- Repealing just ACAfs coverage provisions would save $1.55 trillion through 2027 ($1.75 trillion on a dynamic basis).

- Repealing ACAfs coverage and revenue provisions would save $750 billion ($950 billion on a dynamic basis) through 2027.

- Delaying repeal of most coverage provisions but not revenue offsets or mandates would significantly reduce potential savings. A 4-year delay would reduce savings to $300 billion ($500 billion on a dynamic basis).

- Repealing ACA would increase the number of uninsured people by 23 million.

- Legislation to replace the ACA with other coverage provisions could be costly, likely requiring policymakers to retain the majority of ACAfs offsets.

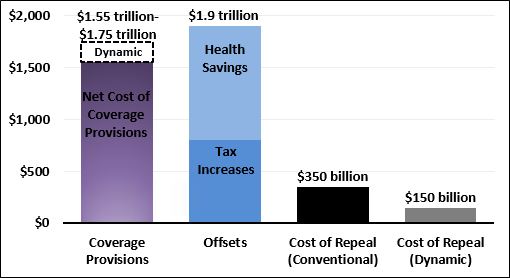

Fig. 1: Budgetary Effects of Fully Repealing the Affordable Care Act (Billions)

Source:CRFB calculations based onCongressional Budget Office data. Estimates are rough.

Note: Unlike CBO, CRFBfs definition of coverage provisions includes the Prevention Fund, increased Medicaid spending for territories and home and community-based services and excludes the Cadillac tax, which is included in tax increases.

Breaking Down the Costs of Full Repeal

By our estimates – based largely on whatfs available from the Congressional Budget Office (see appendix II for details) – a full repeal of the ACA would cost $350 billion through 2027 under conventional scoring and $150 billion under dynamic scoring. Both estimates would be about $100 billion lower through 2026 (see appendix I for full estimates through 2026).

Repealing the ACAfs coverage provisions would save $1.55 trillion through 2027, while repealing its tax increases would cost $800 billion, and repealing its Medicare (and related) cuts would cost another $1.10 trillion. Repeal would also lead to a small increase in economic growth, which could produce over $200 billion of additional net savings.

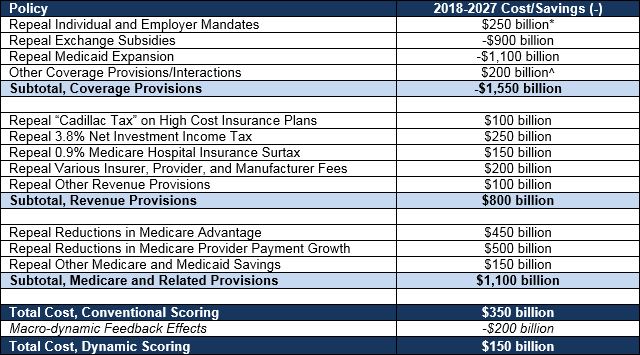

Coverage Provisions – Of the $1.55 trillion in savings from repealing the ACAfs coverage provisions, $900 billion comes from repealing insurance and cost-sharing subsidies and $1.10 trillion from repealing the Medicaid expansion. These savings are partially offset by $250 billion of cost from repealing the legislationfs insurance mandate penalties and another $200 billion from interactions and various other provisions.

Fig. 2: Budgetary Effects of Fully Repealing the Affordable Care Act

Source: CRFB calculations based on Congressional Budget Office data; numbers rounded to nearest $50 billion.

*Excludes interactions with other provisions

Includes Prevention Fund, increased Medicaid spending for territories, and funding for home and community-based services; excludes revenue from the Cadillac tax.

Revenue Provisions – About half of the $800 billion of revenue loss from repealing ACAfs taxes comes from removing the 0.9 percent Medicare payroll surtax on wages above $200,000 ($150 billion) and the 3.8 percent surtax on investment income above the same threshold ($250 billion). Another quarter of the revenue loss comes from repealing various fees on insurance companies, medical device companies, and drug manufacturers. Repealing the gCadillac taxh on high-cost insurance plans costs $100 billion over a decade; those costs are slated to grow substantially over time, and repealing the Cadillac tax without a replacement would also remove a key tool in helping to slow overall health care cost growth.

Medicare Provisions – Of the $1.10 trillion of costs from repealing the ACAfs Medicare (and related) cuts, roughly $450 billion would come from reversing Medicare Advantage cuts and roughly $500 billion would come from ending reductions in the growth of provider payments in fee-for-service Medicare. Our repeal estimates assume that the reductions in Medicare provider payments already implemented under the ACA are retained and repeal only prevents future cuts. If past cuts are also reversed, repeal could cost $200 billion to $250 billion more over a decade.

Dynamic Feedback – As mentioned before, repealing the ACA would also likely increase the size of the economy by about 0.5 to 1.0 percent by the end of the decade, mainly by reversing the incentive that income-related premium subsidies create to reduce hours worked. Were this economic boost to materialize, it would generate about $200 billion of additional net savings.

Budgetary Effect of Partial Repeal

Repealing the entire ACA would leave no funds available for greplaceh legislation, and in fact would require further deficit reduction to avoid adding to the debt. However, a number of partial repeal options also exist.

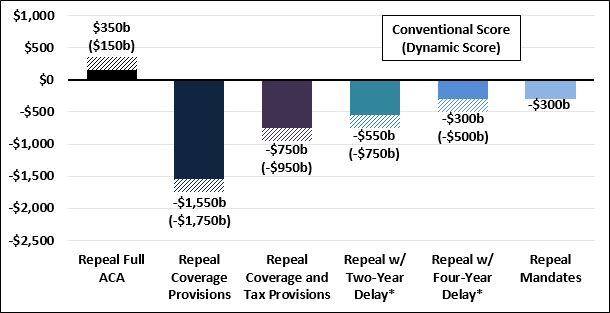

If policymakers repealed only the individual and employer mandates, the government would save about $300 billion over a decade as fewer Americans took advantage of government-subsidized health care. Assuming that gguaranteed issueh and related insurance regulations remained in place, CBO estimates repealing the individual mandate would increase the number of individuals without insurance by about 15 million (repealing the employer mandate would have a small additional effect). Modifications to guaranteed issue and related rules could increase the insurance rate but would likely also reduce budgetary savings from repealing the mandates.

Repealing all coverage provisions – but retaining the ACAfs Medicare reductions and tax increases – would save about $1.55 trillion, or $1.75 trillion on a dynamic basis. According to CBO, this change would likely increase the number of uninsured by 23 million, though significant funds would be available for greplaceh legislation to expand coverage.

Meanwhile, repealing all coverage and tax provisions but keeping the ACAfs Medicare changes in place would save nearly $750 billion, or over $950 billion on a dynamic basis.

Of course, temporarily retaining the ACAfs coverage subsidies and Medicaid expansion would reduce potential savings. For example, repealing mandates and taxes immediately while repealing other coverage provisions 2 years in the future would save $550 billion, or $750 billion on a dynamic basis. A 4-year delay for repealing the coverage provisions would save $300 billion, or $500 billion on a dynamic basis.

Fig. 3: Cost/Savings (-) of Different Repeal Scenarios (Billions)

Source: CRFB calculations based on Congressional Budget Office data

Note: First number represents conventional score. Number in parentheses represents dynamic score.

*Assumes revenue and mandate provisions are repealed immediately, Medicaid expansion and exchange subsidies are repealed on a delay, and most other provisions are retained.

Toward Fiscally Responsible Repeal and Replace

Any changes to the ACA should be designed to reduce, not increase, the unsustainable growth in the federal debt. Savings from repealing parts of the ACA must be large enough to not only finance repeal of any of ACAfs offsets, but also to pay for whatever greplaceh legislation is put forward. This is not an easy task, and it will likely require policymakers to retain or replace the majority of ACAfs health and revenue offsets.

Repeal and replace should also, of course, be evaluated on other parameters – including what it does for coverage, economic growth, and individual premium costs.

Perhaps most importantly, repeal and replace should aim to continue the recent slowdown in health care costs. This will require building upon the parts of the Affordable Care Act that appear to have worked to slow cost growth, learning from the parts that have not, and pursuing new changes to address areas of health reform that the ACA may have missed. In the coming days, wefll discuss more about what must be done to keep health care cost growth under control. It is imperative that policymakers avoid a return to the rapid and unsustainable health care cost growth that threatened and in many ways continues to threaten families, businesses, and our nationfs fiscal future.

Appendix I: The Cost of Repealing the ACA Through 2026

Our estimates focus on the fiscal implications of repealing the Affordable Care Act over the ten-year budget window ending in fiscal year 2027 (FY2027). However, repeal legislation is likely to be pursued under reconciliation instructions from the FY2017 budget resolution (currently being considered, almost nine months late) which goes only through FY2026. Repeal estimates, for purposes of enforcing reconciliation, will therefore focus on the ten-year budget window ending in FY2026 – though CBO may still provide estimates through FY2027 as well.

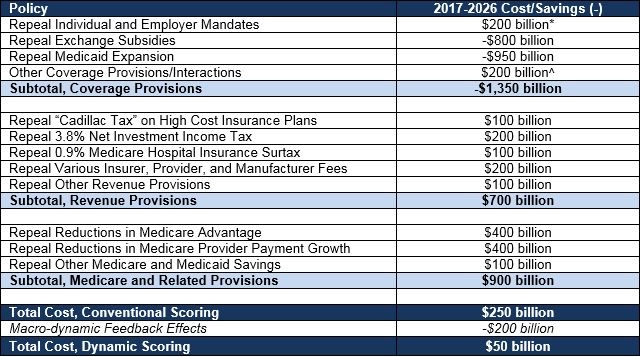

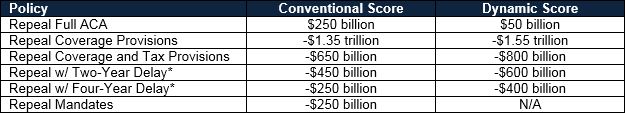

Through FY2026, we estimate full repeal will cost $250 billion ($50 billion on a dynamic basis), the net impact of $1.35 trillion from repealing coverage provisions, $900 billion from repealing Medicare reductions, $700 billion from repealing tax increases, and nearly $200 billion from dynamic effects.

Fig. 4: Budgetary Effects of Fully Repealing the Affordable Care Act Through 2026

Source: CRFB calculations based on Congressional Budget Office data; numbers rounded to nearest $50 billion.

*Excludes interactions with other provisions

^Includes Prevention Fund, increased Medicaid spending for territories, and funding for home and community-based services; excludes revenue from the Cadillac tax.

In terms of partial repeal, repealing the mandates would save $250 billion, repealing all coverage provisions would save $1.35 trillion ($1.55 trillion under dynamic scoring), and repealing all coverage and tax provisions would save $650 billion ($800 billion under dynamic scoring). Repealing all tax and mandate provisions immediately while delaying the repeal of other coverage provisions would save $450 billion for a 2-year delay ($600 billion on a dynamic basis) and $250 billion ($400 billion on a dynamic basis) for a 4-year delay.

Fig. 5: Cost/Savings (-) of Different Repeal Scenarios Through 2026 (Billions)

Source: CRFB calculations based on Congressional Budget Office data

*Assumes revenue and mandate provisions are repealed immediately, Medicaid expansion and exchange subsidies are repealed on a delay, and most other provisions are retained.

Appendix II: Notes on Cost Estimates

The estimates in this paper reflect rough and rounded estimates of ACA repeal by the staff of the Committee for a Responsible Federal Budget (CRFB) and should not be interpreted as an official score. All numbers are rounded to the nearest $50 billion.

Estimates outside of appendix I are for the new ten-year budget window ending in 2027 and are measured relative to Congressional Budget Office (CBO) current law baseline. Estimates also assume all changes begin on January 1, 2018. In addition, we assume the repeal legislation would leave untouched any part of the Affordable Care Act that has been built upon in other legislation (for example, income-related Medicare premiums) and that changes to provider payments that have already gone into effect would remain in place (but no further reductions in the growth rate of provider payments would be allowed).

CRFBfs estimates are based primarily on three sources: CBOfs December 2016 report gOptions for Reducing the Deficit: 2017 to 2026," which estimates repeal of coverage provisions; CBOfs scores of the 2015 reconciliation bill, which repealed the ACA coverage provisions and taxes after a two-year delay; and CBOfs June 2015 analysis of the budgetary and economic effects of repealing the Affordable Care Act. CRFB also relied in part on CBO's February 2011 score of ACA repeal to estimate specific sources of Medicare savings. Staff adjusted these estimates in a number of ways to reflect how we believe CBO would score repeal legislation introduced in 2017.

Some experts believe changes in the Affordable Care Act are partially responsible for the recent slowdown in health care cost growth, beyond what is reflected in the official score. Others argue that the provider reductions in the Affordable Care Act are unsustainable and will ultimately be destabilizing. Like CBO, CRFB does not incorporate either assertion into our score.

Previously, CRFB estimated full repeal of the Affordable Care Act would cost nearly $500 billion from 2017-2026 on a conventional basis, which would likely be the equivalent of about $600 billion from 2018-2027. The significant reduction in todayfs cost estimate largely reflects the increased cost of coverage resulting from recent premium hikes.

CRFB will continue to refine its estimates in the coming weeks and months and will also provide estimates for various other partial repeal as well as greplaceh options.